What is Cryptocurrency?

Cryptocurrency is a form of money available in a digital or electronic form, also known as a Digital Asset. The AICPA classifies cryptocurrency as a ‘Digital Asset,’ which it defines as “A digital record that is made for verification and security purposes. Digital assets are also referred to as cryptocurrencies, such as Bitcoin. These new digital assets are in digitized form and are recorded and stored on a distributed ledger, known as a blockchain.”

Bitcoin and other digital assets can be used for investment, operational and transactional purposes. Large companies such as Starbucks, AT&T, and PayPal have started accepting various cryptocurrencies as payment for their goods and services. Wikipedia also allows donations in Bitcoin, and Microsoft accepts Bitcoin payments to top up your Microsoft account.

As of 2021, there are over 31K crypto ATMs worldwide where you can purchase Bitcoin and other digital assets with deposited cash.

Why the Rise in Popularity?

Cryptocurrencies have become popular for their ability to transfer assets in real-time with little to no transaction fees. The network structure is “peer-to-peer,” so there is no middleman, no brokerage fees, and usually no transaction commissions. The nature of the blockchain ledger provides a level of transparency and clarity in transacting that allows for easily established audit trails. Transaction information is cemented in the blockchain and cannot be edited or deleted after the transaction.

International Cryptocurrency

Cryptocurrency also allows you to send and receive currencies internationally in an easier and more cost-effective way. By their nature, cryptocurrencies are not subject to exchange rates and costly transaction charges common in the international marketplace.

Should you be more crypto-conscious?

The cryptocurrency and digital asset space changes every day. Not even the most highly knowledgeable individuals can predict where this innovative technology is heading. Many feel that digital assets will change the modern financial banking system as we know it. Others think that factors such as governmental regulation will slow or even eliminate growth and adoption.

Cryptocurrency Gets Regulated

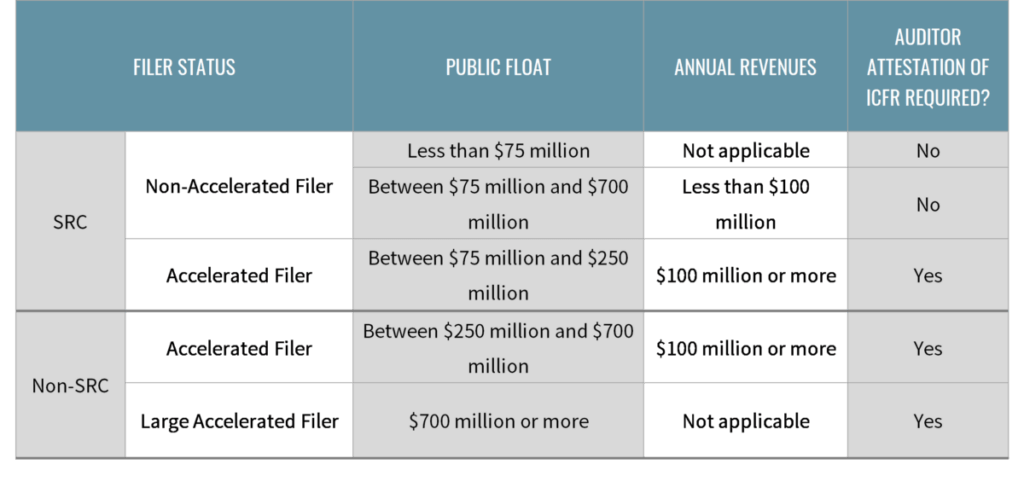

In November 2021, the Infrastructure Investment and Jobs Act (H.R. 3684) was voted into law, which included Section 80603, “Information Reporting for Brokers and Digital Assets”. This law section created various new rules and requirements for cryptocurrency exchanges.

Namely, all US cryptocurrency exchanges (such as Robinhood, Coinbase, and BinanceUS) are now considered brokers under the traditional sense of the term. This means these cryptocurrency exchanges will now be regulated by the same laws as household name brokers such as TD Ameritrade or Charles Schwab.

Another result of this new law states that Digital Assets will be treated like all other securities regarding capital gains and losses. Digital Assets will be regulated like stocks and bonds under the Securities and Exchange Commission (SEC).

Reporting Laws Strengthen

Reporting requirements under the new law have also been strengthened considerably. Cryptocurrency exchanges are now required to report specific information to both the IRS and their customers. Required information includes gross proceeds of the sale of digital assets, capital gains and losses, and other customer information such as name, address, and phone number of investors.

Crypto Question Still to be Answered in the U.S.

These new requirements change the landscape of the cryptocurrency space in the United States. Are cryptocurrency exchanges in a position to abide by these new reporting conditions? Is it plausible to put the onus on exchanges to accurately track and report gains and losses for every single customer transaction on their platform so early in the development of the industry? These questions are top of mind for all cryptocurrency advocates, investors, and professionals.

Section 80603 of the Infrastructure Investment and Jobs Act will be enforced federally, and adhering to these increased regulations may send entrepreneurs and innovators abroad to more easily build and develop their cryptocurrency technology.

Learn Now to Flourish Later

With the uncertainty surrounding the industry, it is extremely difficult to predict where the space is truly heading. Being informed about cryptocurrency’s meteoric rise onto the financial world stage can position you in a way to more easily adapt to the continually changing technology.

We have seen the growth of Cryptocurrency and how much it has affected today’s economy. Currently, we do not offer cryptocurrency-specific services, but our practice staff has experience working with and auditing cryptocurrency. Visit our audit page to see the services we offer or contact us.