Action Sports

Sensiba’s action sports industry practice group is passionate about our clients and the pursuit of adrenaline rushes from surfing, skating, biking, boarding, riding, slack line and more. We proudly support our communities and those organizations that enable our lifestyles, including Surfrider Foundation, Tour de Cure and many more.

Services

Services for Growing Organizations

Audit & Assurance

Our goal is to be your go-to resource for financial reporting and compliance support. You can call on our deep industry expertise to deliver insights about where your business stands today—and how you can manage risk and achieve growth for a strong future.

Risk Assurance

We have experts to help you navigate the risks that affect the value of your business. Our approach to risk assessment and mitigation is designed to meet your unique security, attestation, and compliance needs.

Tax

We are committed to helping you achieve your financial goals with strategies tailored to you, so you can move forward with confidence and peace of mind.

Consulting

Build an agile organization ready for any challenge. We bring people and technology together to overcome complexity and unlock business opportunity.

Software

Wherever you are on your digital transformation journey, we help you build a technology roadmap to enable better decision-making, mitigate risk, and improve productivity.

Sustainability

You want to build a sustainable future for your business and your stakeholders. As a Certified B Corporation, we have the experience to support your ESG journey—from assessment and strategy to implementation and disclosure.

News, Events and Insights

The Latest from Sensiba

What to Expect During The 401(k) or 403(b) Audit Process

What should you expect during a 401(k) or 403(b) audit? From the 80–120 rule to the final Form 5500 filing,…

Unlock Cash Flow with the Year-end Bonus Accrual Deduction

What if you could legally use a time-warp to lower your tax burden? Discover how accrual-basis businesses accelerate deductions to…

The Big Switch: Weighing the Costs of Converting a C Corp to an S Corp

Thinking about switching from a C Corp to an S Corp? Learn how to unlock tax savings while avoiding the…

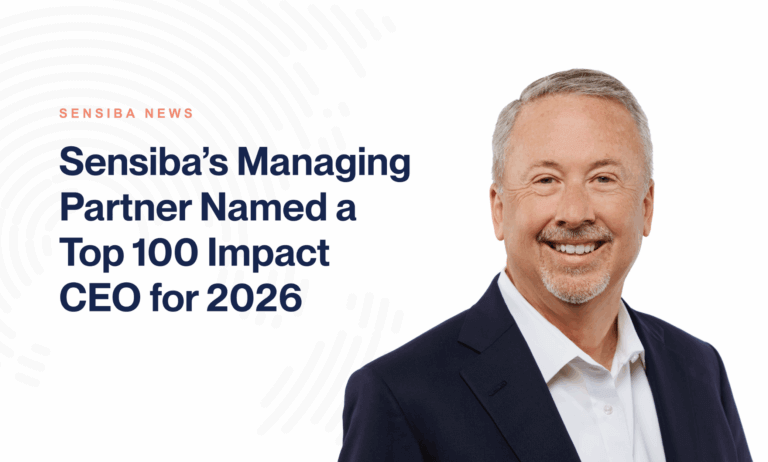

Sensiba’s Managing Partner Named a Top 100 Impact CEO for 2026

We’re thrilled to announce that John Sensiba, Managing Partner of Sensiba, has been recognized as one of the Top 100…

Let’s talk about your project.

Whether you need to unravel a complex challenge, launch a new initiative, or want to take your business to the next level, we’re here. Share your vision and we can help you achieve it.