Internally developed software designed to serve customers under the Software as a Service (SaaS) model must be accounted for according to Accounting Standards Codification (ASC) 350-40 Intangibles—Goodwill and Other, Internal Use Software.

Accounting Standards Update (ASU) 2025-06 modernizes how companies account for internal-use software costs. It achieves this by removing the prescriptive project stage model, introducing a new capitalization threshold, and aligning website development costs with other internal-use software. The standard becomes effective for calendar year ends Dec. 31, 2028, though early adoption is permitted.

The implementation of this new standard applies to all internal-use software development activities, including website development, across the organization. The rules cover both new projects and projects that are already in progress as of the adoption date.

When to Expense Costs

All internal and external costs incurred before meeting the capitalization requirements must be expensed immediately as they occur. Specifically, internal and external training costs and data conversion costs are not classified as internal-use software development costs under this standard, and therefore must also be expensed as incurred.

Criteria for Capitalization

Capitalization of costs may only begin when two specific criteria are met. First, management with the relevant authority must implicitly or explicitly authorize and commit to funding the computer software project. Second, it must be probable that the project will be successfully completed and that the software will be used to perform its intended function. To determine if the probable-to-complete recognition threshold has been met, the entity must assess whether any significant uncertainty is associated with the software’s development activities.

Resolving Development Uncertainty

If significant development uncertainty exists, the probable-to-complete threshold is not met until that uncertainty has been fully resolved. Significant development uncertainty is considered present if either of the following two factors exists:

- The software being developed includes technological innovations or novel, unique, or unproven functions or features, and the uncertainty related to those elements has not yet been resolved through coding and testing.

- The significant performance requirements of the software have not been clearly identified, or the identified significant performance requirements continue to be substantially revised.

Conclusion of Capitalization and Replacements

Capitalization must stop no later than the point at which a computer software project is substantially complete and ready for its intended use.

Additionally, any new software development activities must prompt a consideration of the remaining useful lives of any existing software that will be replaced. When an entity replaces existing software with new software, the unamortized costs of the old software must be expensed when the new software is ready for its intended use.

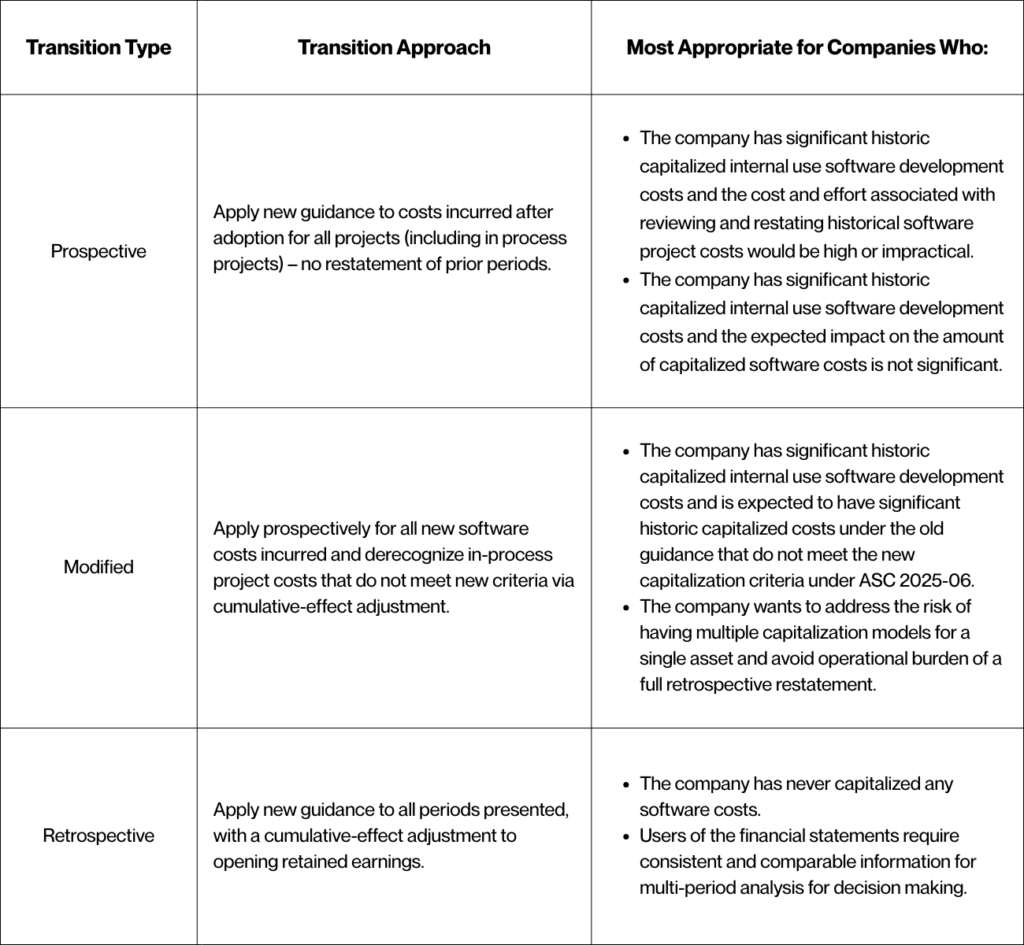

For ASU 2025-06, entities may elect one of three transition methods:

Our team of experts is available to support you and ensure the right calls are made. Get in touch with our technology audit team today.