Starting for tax years beginning on or after January 1, 2025, Michigan’s updated R&D tax credit—codified under Public Act 187 of 2024— updates the incentive for businesses investing in research and development within the state.

This credit is designed to stimulate innovation, support small businesses, and encourage collaboration with Michigan’s research universities. For the last 13 years, many companies in Michigan could not use the credits generated under the state’s Corporate Income Tax (CIT) structure.

The legislative changes established a refundable R&D credit aligned with federal standards that can be claimed against Michigan’s CIT and, for certain businesses, against withholding tax for flow-through entities. Credits exceeding a taxpayer’s liability will be refunded, making this a cash benefit rather than just a reduction in tax owed.

Who Qualifies?

To be eligible for the credit, a business must be an “authorized business,” defined as a company that meets the following requirements:

- A CIT taxpayer

- A flow-through entity (e.g., S corporations, partnerships, LLCs taxed as partnerships)

- Subject to Michigan income tax withholding under MCL 206.703

- Not subject to the Michigan Business Tax (MBT) under 2007 PA 36.

What Expenses Are Includable?

As is typical with state R&D credits, only qualified research expenses (QREs) under IRC §41(b) incurred within Michigan are includable. The Michigan base amount is calculated as the average of the prior three years’ Michigan QREs. If fewer than three prior years of QREs exist, the average is based on available years; if none (for example the company’s first year of R&D or first time in four years with an R&D project), the base is zero.

How Much is the Credit?

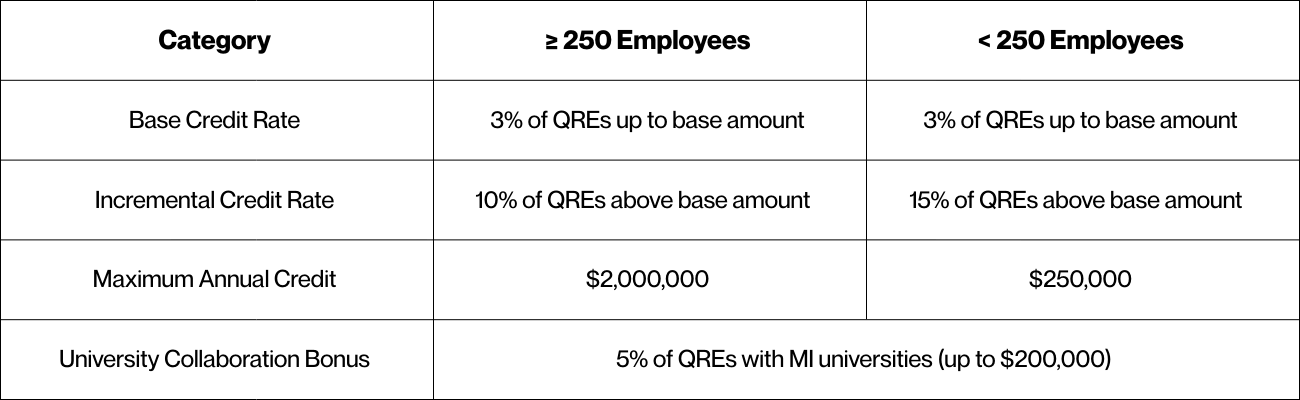

The state offers two tiers of credit based on company size. An additional bonus amount is available if the research is conducted with a Michigan university.

How Do I Claim the Credit?

Companies must submit a tentative claim to the Michigan Department of Treasury by April 1, 2026, for 2025 expenses. The state indicates additional information for the administration of the credit will be required on the form. For future years, the deadline is March 15 following the tax year; e.g. March 15, 2027, for the 2026 credit.

The Treasury will publish the allocation rates on their website, indicating if any pro-rata rates apply. The final amount will then be claimed on the annual tax return, with any excess credits being refunded rather than carried forward.

What Else?

Total credits issued are capped at $100 million, with a reserve of at least $25 million for companies with fewer than 250 employees. If total credits requested exceed the allocations, the final credit is a pro-rata share of the tentative credit.

The credits cannot be sold or assigned.

Currently, there are still a few outstanding questions the legislation does not specify:

- The state Treasury has not yet released the application or updated tax forms, preventing companies from proactively compiling the required information.

- The timeline for the Department of Treasury to announce the credit allocation is unclear, especially as the April 1, 2026, deadline comes after the federal statutory filing deadline for flow-throughs and is only two weeks before the individual filing deadline.

- The exact definition of “employee” and how to count part-time, seasonal, and personnel who start or leave employment, has not been finalized. Especially in industries with high turnover rates and companies right at the threshold, this could be a 5% difference on the incremental QREs.

What Now?

This credit offers a meaningful opportunity for Michigan-based businesses, especially small and mid-sized firms, to reduce tax liability while investing in innovation. The university collaboration bonus further encourages partnerships that drive long-term economic growth.

To learn more about the Michigan R&D credit and how it may affect your company, contact us.