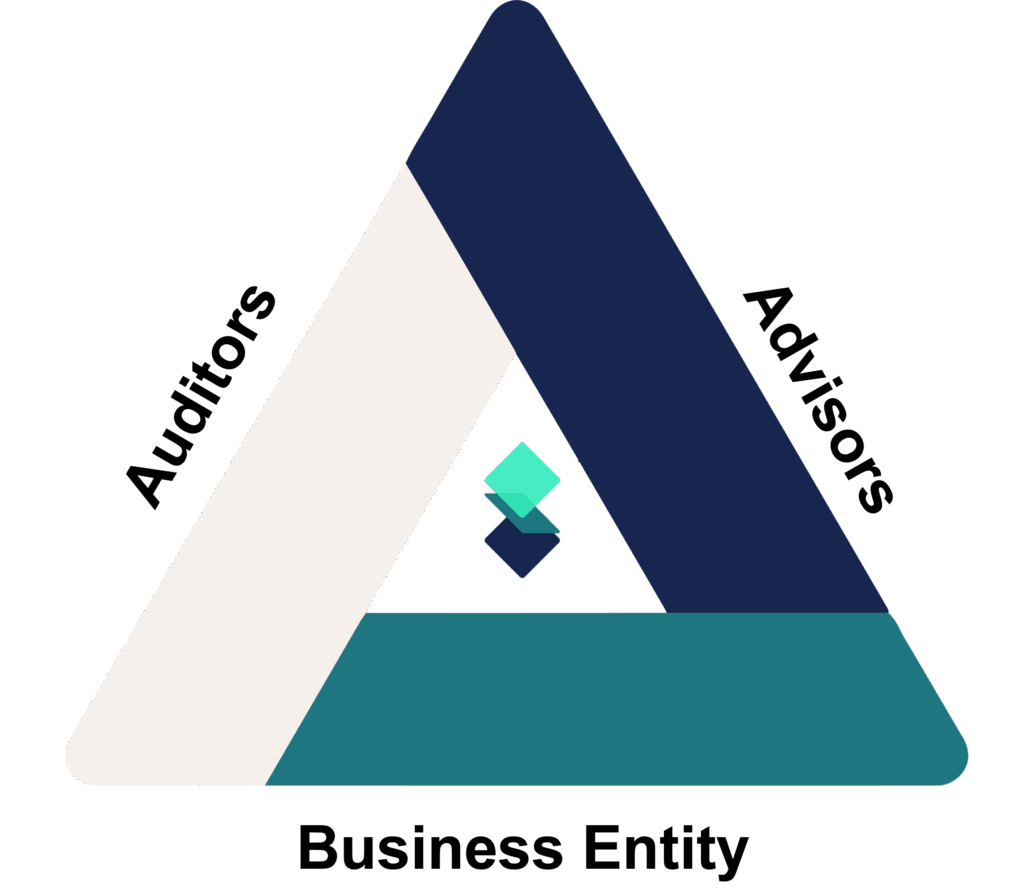

In today’s risk-aware business environment, building trust isn’t a solo effort—it’s a coordinated pursuit. For organizations seeking to meet compliance requirements and expand their market presence, success often depends on the strength of a three-way relationship: the business, its compliance advisors, and independent auditors. Known as the “trust triangle,” this dynamic is the foundation for effective compliance and lasting stakeholder confidence.

However, while the three sides of the trust triangle share a common goal—verifiable compliance—their motivations, methods, and languages often differ. Understanding these differences is key to navigating the path forward.

The Three Sides of the Triangle

Businesses: seeking to gain trust and enter the next stage of growth

For most organizations, compliance is not just about ticking boxes—it’s about unlocking growth. Whether the goal is to win larger contracts, attract investors, or strengthen a brand’s reputation, demonstrating compliance reassures stakeholders that operations are secure, ethical, and reliable.

That said, many businesses approach compliance pragmatically. With limited time and resources, they may focus on meeting minimum requirements quickly—sometimes without fully grasping the nuances of each framework. This mindset, while common, can create friction when deeper, long-term value from compliance is the goal.

Advisors: guiding the path to compliance

Compliance advisors are a guide, offering deep expertise across industries, standards, and jurisdictions. Whether internal specialists or external consultants, advisors help organizations implement practical strategies that align business operations with regulatory demands.

They speak the language of risk, assessing where organizations are vulnerable, what frameworks apply, and how to prioritize improvements. By bridging business goals and regulatory requirements, advisors provide the roadmap for scalable, sustainable compliance.

Auditors: verifying trust and compliance

Auditors are the objective third party in this triad. Their job is to independently assess whether a business has met the requirements of a given framework—whether SOC 2, ISO/IEC 27001, HIPAA, or others.

Auditors communicate through the language of precision and evidence. Their focus is on technical accuracy, documentation, and clearly defined tests. Ultimately, they provide the attestation or certification that validates an organization’s efforts and delivers trust to external stakeholders.

Shared Goals, Distinct Perspectives

The three-sided relationship has the common objective of ensuring the business achieves compliance, although this shared goal often has differing motivations to get there.

Businesses: growth and reputation

For businesses, compliance translates into growth. It enables them to attract partners, win contracts, and reassure customers their operations are secure and ethical. While pursuing compliance may involve time and monetary investments, it provides returns in revenue, growth, and enhanced brand reputation.

Advisors: knowledge and partnership

Advisors derive their purpose from guiding businesses toward compliance and trust. Their expertise and vast understanding of regulatory nuances mean they are critical in the compliance process. By partnering with businesses, advisors forge a collaborative journey toward a future founded on integrity and responsible conduct.

Auditors: accountability and assurance

Auditors uphold the critical role of reviewing and signing off on evidence related to the framework. At the end of the day, the auditor will deem a business compliant or not. Their objective evaluations provide the stamp of authenticity, assuring stakeholders that businesses stand by their commitments. The certification that auditors provide not only shows compliance but also provides trust and validates a business’s efforts in their commitment to responsible conduct.

A Common Language Through Compliance Metadata

To bridge these gaps, organizations can leverage compliance metadata—the structured representation of what matters in a compliance program. This includes:

- Scope

- Risks

- Framework mappings

- Controls

- Test procedures

- Policies

Compliance metadata creates a shared understanding that cuts through professional jargon. It acts as a common language that aligns the interests of businesses, advisors, and auditors.

By grounding collaboration in clearly defined metadata:

- Businesses gain clarity on what needs to be done and why

- Advisors can implement controls that are fit for purpose

- Auditors can efficiently assess against well-documented, standardized evidence

This approach reduces friction, supports transparency, and helps ensure the audit process runs smoothly without compromising accuracy or integrity.

As supply chains grow and stakeholder expectations expand, the trust triangle doesn’t stop at the initial audit team. Suppliers, partners, and third-party vendors also become part of the broader compliance network. The trust triangle replicates at scale, fostering a trust web that must be managed with the same rigor and collaboration.

The trust triangle is not just a theoretical framework—it’s a real-world system that underpins every successful compliance journey. When businesses, advisors, and auditors align through a shared understanding of roles and expectations, they create more than just reports—they build the foundation for sustainable growth, accountability, and innovation.

Compliance metadata is the key to this alignment. It enables faster, clearer communication, and unlocks a new era of collaboration where trust and transparency thrive.

Want to strengthen your compliance program through better collaboration and clarity? Contact us to learn how we can help you build a smarter, more unified compliance strategy grounded in trust.