Section 1202 of the Internal Revenue Code provides a tax-friendly incentive for investors in qualified small business stock (QSBS) by allowing eligible shareholders to exclude a portion, or in some cases, all of the capital gains from the sale of stocks in a Qualified Small Business.

A Qualified Small Business (QSB) is defined as:

- A domestic C-Corporation with stock issued after August 10, 1993.

- Aggregate gross assets of $50 million or less (before OBBBA) at all times before and immediately after the issuance of the equity, and

- 80% of the assets are used in the active conduct of one or more qualified trades or businesses.

- Other requirements include but are not limited to industry-specific eligibility. Generally, businesses in technology, manufacturing, retail, wholesale, and product development are more likely to qualify. In contrast, any trade or business involving the performance of service in the fields like law, accounting, health, consulting, etc., financial or investment-related businesses, farming or tree harvesting, mining or resource extraction, and hospitality (hotels, restaurants, etc.) are explicitly excluded from qualifying as QSBS.

Qualified Small Business Stock (QSBS) are shares in a QSB that meet certain criteria defined in Section 1202 of the Internal Revenue Code.

Section 1202 is designed to encourage long-term investment in small businesses by giving QSB owners generous tax benefits and allowing the exclusion of up to 100% of the capital gains on sale or exchange, depending on when the stock was acquired.

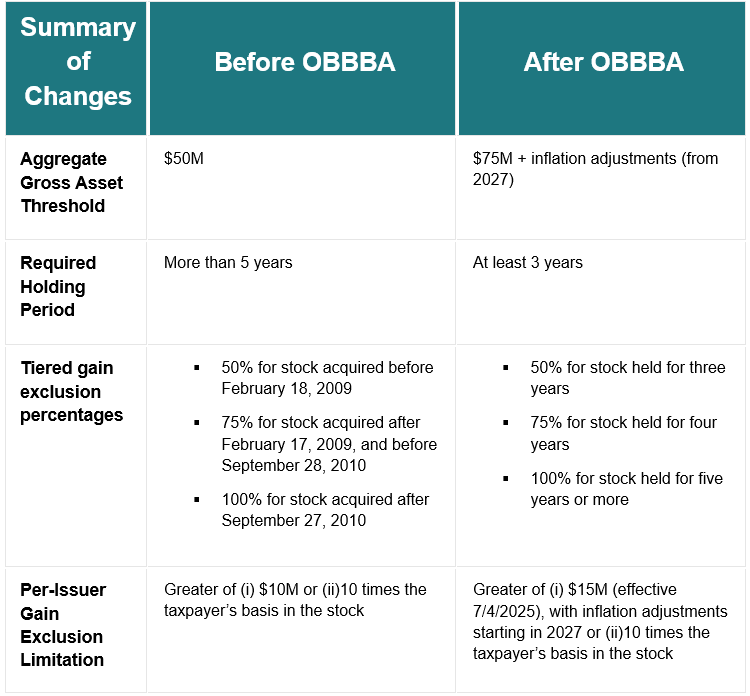

Investors must hold the QSBS for more than five years (before OBBBA) to be eligible for the favorable tax treatment. The exclusion also applies to Net Investment Income Tax (NIIT). The remaining gain, if not fully excluded, is taxed at 28%, but not the 20% preferential long term capital gain rate.

What Did OBBBA Change?

H.R 1. the One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, significantly expands the benefits of Section 1202, making it more accessible and generous for small business investors.

Key Comparisons: Before vs. After OBBBA

Additional Considerations

Grandfathering Rule: Stock issued or acquired on and before July 4, 2025, remains subject to the pre-OBBBA rules. Taxpayers are precluded from exchanging QSBS that would not qualify for the OBBBA expansions for new QSBS that would so qualify via certain carryover basis transactions such as tax-deferred reorganizations.

Planning Implications

The recent changes to Section 1202 have created powerful incentives for early-stage and venture-scale investments. Shorter holding periods and broader eligibility mean founders and investors should revisit entity structures, liquidity events, and equity grants. With a higher exclusion cap, strategic planning is key to securing QSBS benefits and avoiding disqualification due to complex rules.

Pending Guidance

Further IRS guidance is expected, particularly on how to calculate the new asset threshold and coordinate between old and new exclusion caps. This can be complex, especially with changes to Section 174 (which impacts the tax basis of the company’s assets). This change may help companies to stay under the threshold.

See our full article on Section 174 capitalization relief from OBBBA.

To learn more about the changes to Section 1202 and how it affects your situation, contact us.