Internal controls are the processes and procedures that ensure efficient operations, reliable financial reporting, and legal compliance. They provide an important framework for promoting accountability, integrity, and transparency within an organization and play a vital role in helping governmental entities safeguard their financial assets, fulfill their obligations to serve constituents and maintain public trust.

Strong internal controls increase public trust and allow governments to carry out their essential services effectively. They also help guarantee the accuracy of financial information shared with citizens and funding sources.

Internal Controls Challenges for Governments

One of the most common challenges governments face in implementing effective internal controls is their comparatively smaller staffs. With limited budgets, governments are more likely to invest funds in public-facing roles such as teachers or police officers. In contrast, people in operational roles like the finance function are asked to do more with less.

This approach can make preventative controls such as segregation of duties difficult to implement. For instance, tasks such as writing a check, signing that check, and recording the payment should, under ideal circumstances, be performed by separate people to reduce the risks of fraud or errors. But if a finance department has two staff members, this level of segregation isn’t possible.

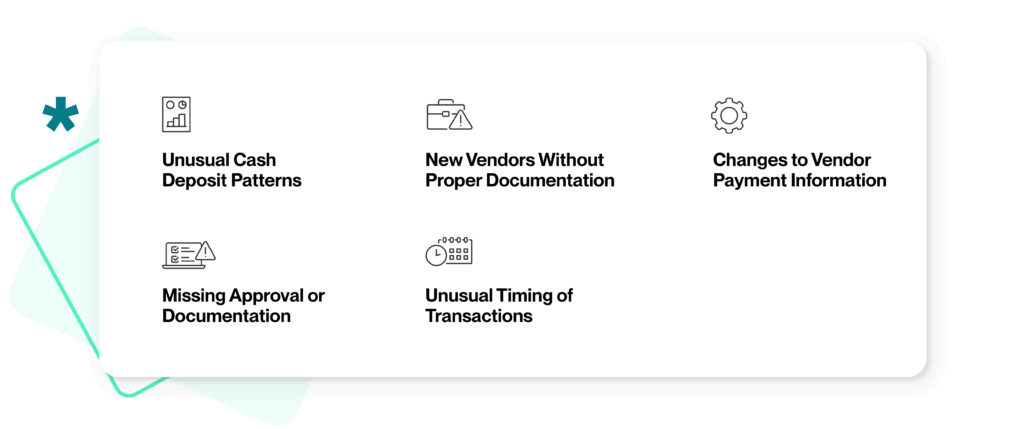

Key Red Flags for Detecting Fraud or Errors

In response, a government finance team should implement a mitigating control designed to reduce the severity or impact of a risk. To address staffing shortages, for instance, creating a procedure such as having the team prepare checks that are later signed by an oversight board member, or a city manager reviewing credits posted within a given period.

In the latter example, the city manager could be given a one-page checklist highlighting common signs of errors or fraud. If they identify a transaction that looks irregular or suspicious, they can contact the city treasurer to investigate the question.

To prevent fraud, obtain bank check images routinely and have someone outside the accounting function review them for unusual activity. This reduces the risk of a bookkeeper writing checks to themself.

Effective internal controls also provide a strong deterrent because staff members are less likely to act inappropriately if they know transactions are reviewed routinely.

Common Fraud Vulnerabilities

Government organizations face particular vulnerability at cash collection points. For example, water utility payments can present a significant risk, especially in smaller municipalities where customers frequently pay in cash at local offices. Similarly, event tickets for school sporting events and student activities generate substantial cash that requires careful handling.

Disbursement processes, particularly vendor verification, represent another critical control point. Fraudsters can establish fictitious companies that submit invoices for payment, counting on overworked staff to process them without adequate scrutiny. Prevention strategies include:

- Verifying new vendors through a Secretary of State’s business registry.

- Confirming tax identification numbers.

- Requiring multiple approvals for adding vendors to the system.

Similarly, regular reviews of payroll changes by someone outside the payroll department can detect unusual patterns such as employees without deductions, address changes that might indicate diverted payments, or unauthorized pay rate increases. Implementing formal authorization protocols for all changes can strengthen this control environment further.

Internal Controls Framework

For governments looking to create or upgrade their internal controls, several frameworks can provide valuable guidance. The COSO framework, for instance, is an internal control system designed to help organizations improve their oversight and governance practices. The COSO framework includes five interconnected components:

- The control environment highlights the importance of ethical values.

- Risk assessments involve identifying, evaluating, and mitigating potential losses.

- Control activities include the policies and procedures implemented to mitigate risks and ensure the organization’s objectives are met.

- Information and communication activities ensure relevant information is shared throughout the organization and with external stakeholders.

- Monitoring activities assess the effectiveness of internal controls and identify areas for improvement.

Government Financial Cyber Threats

Government organizations are prime targets for cybercriminals seeking to exploit financial systems through sophisticated digital attacks. Phishing scams represent one of the most prevalent threats. Attackers often leverage inside knowledge gleaned from compromised email accounts to create convincing scenarios, such as people pretending to be leaders and requesting the immediate transfer of funds.

Wire fraud schemes similarly target government entities by impersonating legitimate vendors requesting banking information changes. These attacks succeed because perpetrators understand that government finance teams are often understaffed.

Solutions and Best Practices

Prevention strategies must center on comprehensive employee training programs that equip all staff—not just finance personnel—to recognize and respond to potential threats. Establishing secondary verification processes for fund transfers above a certain threshold, particularly requiring approval from someone outside the typical authorization chain, provides an additional layer of protection against social engineering tactics.

When fraud is detected, immediate response can mean the difference between recovery and permanent loss. Government organizations should maintain a documented response plan with clear protocols for freezing accounts, contacting law enforcement, preserving evidence, and notifying relevant stakeholders.

Your plan should identify specific responsibilities and include after-hours contact information for key personnel since attacks are often timed outside normal working hours.

Further Assistance

By anticipating common exposures and developing effective internal controls to prevent or detect loss, governmental entities can improve their risk management initiatives and reduce the chances of financial errors or fraud, diluting their ability to serve constituents and fulfill their primary purpose.

To learn more about creating effective internal controls for government entities, contact us.