U.S. companies with major customers, subsidiaries, or parent companies in Europe need to determine whether they’re required to make disclosures under the European Union’s Corporate Sustainability Reporting Directive (CSRD). Disclosures may be expected as early as 2025, depending upon such factors as headcount, revenue, and status as a publicly traded entity.

The CSRD is an EU regulatory framework designed to enhance corporate sustainability reporting and to promote environmental, social, and governance (ESG) considerations. The regulation is also intended to support investors and other stakeholders in evaluating climate- and sustainability-related risks and opportunities that may affect a businesses’ future cash flows and long-term resilience.

What Do Companies Report Under the CSRD?

Under the CSRD, companies (known as “undertakings” in the regulation) must conduct a “double materiality” assessment to identify material sustainability issues from two perspectives:

- Impact materiality: How the company’s activities affect society and the environment.

- Financial materiality: How sustainability issues impact the company’s financial performance and value.

Reporting area requirements cover governance processes and controls, the incorporation of material impact areas into overall business strategy, and impact, risk and opportunity management. CSRD disclosures cover a broad range of ESG issues, such as:

- Climate change risks and mitigation efforts

- Pollution prevention and control

- Resource use and circular economy initiatives

- Workforce diversity, working conditions, and work/life balance

- Human rights in the value chain

- Consumer and product safety

- Business ethics and conduct

- Anti-corruption measures

- Board diversity and oversight of sustainability

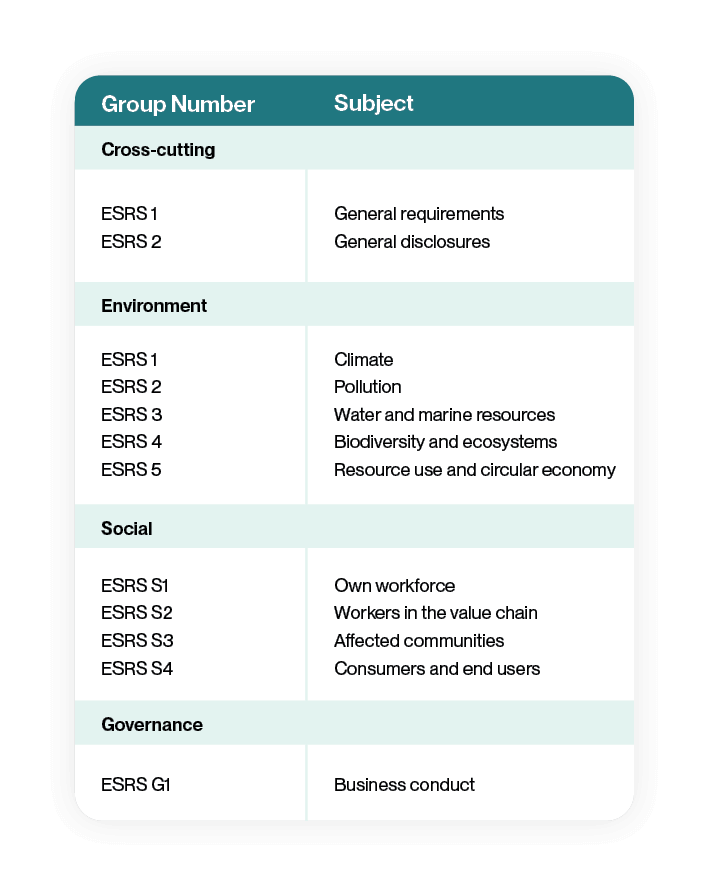

The related European Sustainability Reporting Standards (ESRS) outline the specific information companies are required to report under the CSRD. The ESRS (see table) includes two general (or “cross-cutting”) categories and 10 standards covering various ESG topics.

12 ESRS Standards Shaping CSRD

In addition to historical data, companies are required to disclose forward-looking information on their sustainability metrics, targets, and progress. Sustainability information must also be included in the entity’s Management Report.

Each filer’s sustainability disclosures must be audited independently for accuracy and completeness. This assurance will be limited at first but may expand over time.

Who Has to Report Under the CSRD?

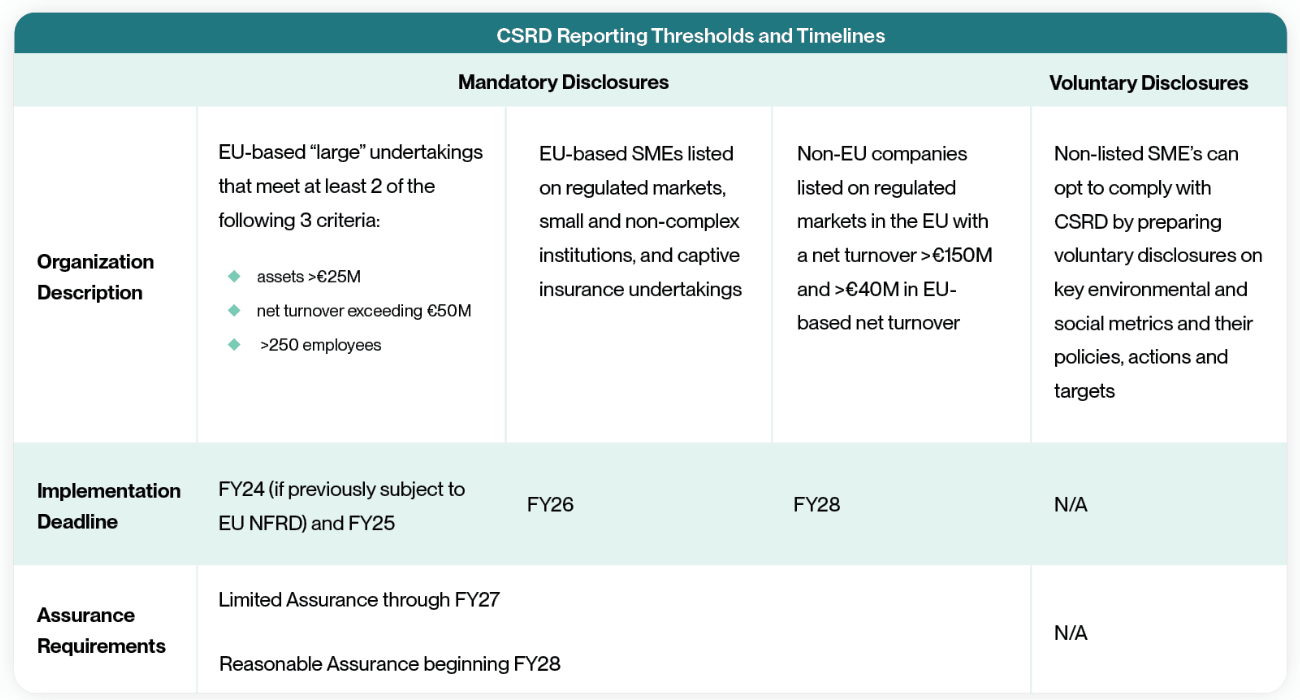

The CSRD establishes a range of reporting criteria and effective dates for mandatory reporting. Large enterprises began reporting in 2024 if they were previously subject to the Non-Financial Reporting Directive (NFRD). Other large companies will begin reporting in 2025.

Large undertakings are defined as entities that meet at least two of the following criteria:

- Total assets exceeding €25 million.

- A net turnover exceeding €50 million.

- More than 250 employees, on average, during the financial year.

The relatively low reporting thresholds will likely mean a range of companies that don’t consider themselves to be large will have to meet the CSRD’s requirements.

Companies listed on regulated markets in the EU, including small and medium-sized enterprises (SMEs), must comply with the CSRD starting in 2027.

Beginning in 2027, non-EU companies with a net turnover above €150 million in the EU will need to comply if they have at least one subsidiary or branch in the EU with more than €40 million in net turnover.

CSRD Reporting Thresholds and Timelines

Large Customer Compliance Requests

Beyond any direct compliance requirements, U.S. companies will need to prepare a variety of disclosures in response to requests from large customers that are required to report on their own. Because those disclosures include the larger organizations’ value chains, many will be asking their suppliers for detailed information about CSRD reporting topics such as greenhouse gas emissions and other ESG data.

Companies throughout the value chain will need to identify their emissions-generating activities and develop reliable systems, controls, and procedures to ensure information is shared with customers accurately.

Recognizing the complexity of obtaining this information from a range of suppliers, the EU is allowing reporting companies to use estimates for value chain reporting after making reasonable efforts to do so. This will likely change as reporting becomes more common and stakeholder expectations increase.

Voluntary SME Disclosures

The Voluntary European Sustainability Reporting Standards (VSME) are a related effort designed to allow non-listed SMEs to comply with stakeholder information requests by preparing voluntary disclosures similar to those outlined in the CSRD and ESRS.

The VSME features three modules:

- The Basic Module outlines environmental and social metrics, including Scope 1 and 2 emissions.

- The Narrative Module includes descriptions of the entities’ Policies, Actions, and Targets.

- The optional Business Partners Module outlines information that may be requested from banks, investors, and other stakeholders.

Implementation FAQs

To make it easier for companies to understand and comply with the CSRD reporting requirements, the EU has published an FAQ document outlining the directive’s scope, application dates, and exemptions.

Sensiba has made incorporation of the ESRS standards a core part of our ESG Assessment process. To understand the benefits of planning for disclosures and assess relevance to your business, contact our team to learn more.