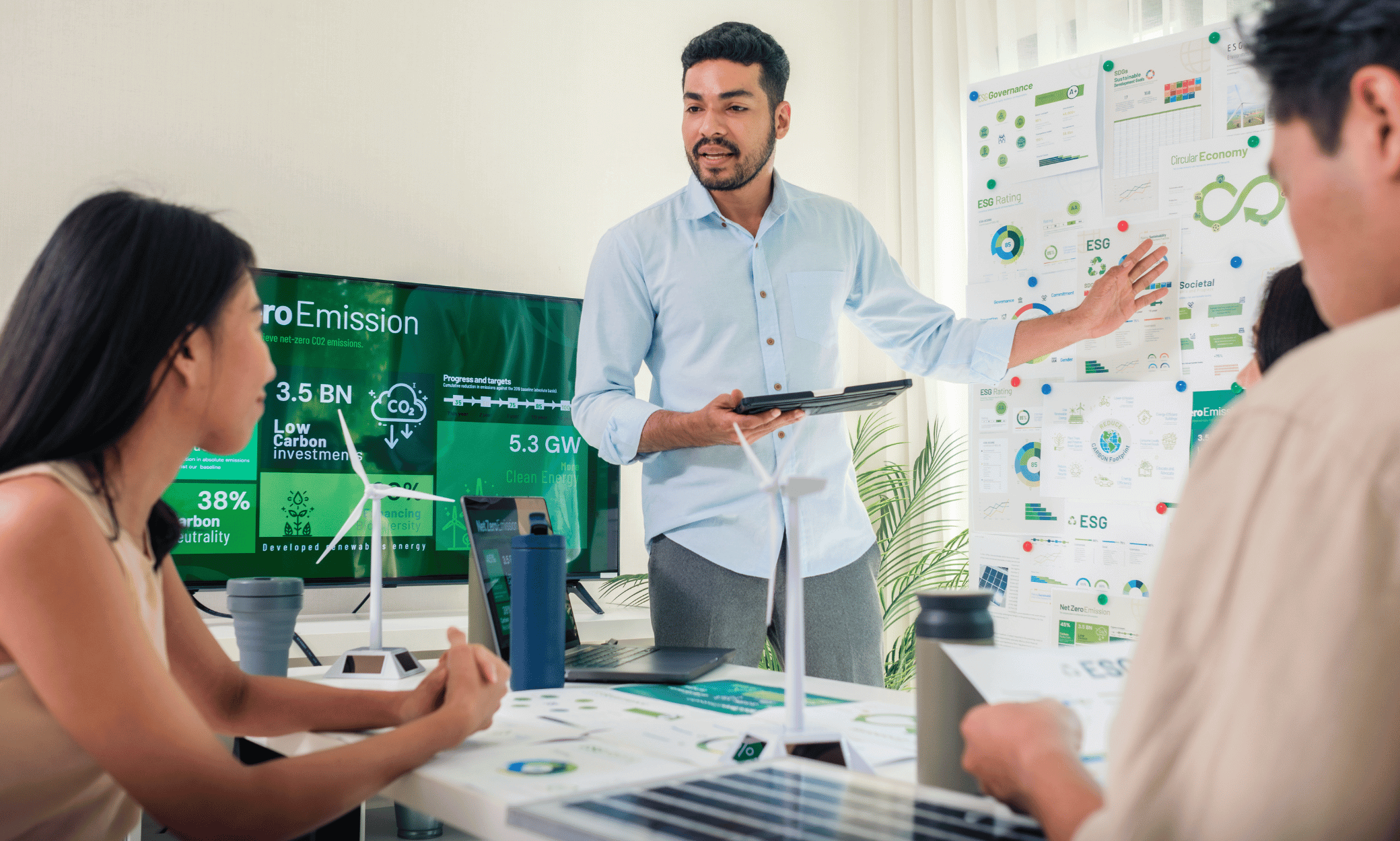

Corporate responsibility is a growing priority and has significantly increased in importance to consumers, investors, and other key stakeholders for both public and private companies. This emerging cultural movement concerning Environmental, Social, and Governance (ESG) metrics from corporations has caused an exponential increase in the number of ESG reports conducted by companies across all sectors.

Not All Reports are Made Equally

While increased ESG reporting is generally seen as a proxy for progress, these ESG reports are often misleading, nonstandard, and imprecise. Most companies do not engage in third-party verification of their ESG reports, leading to ambiguous and incomplete data.

Due to the lack of mandatory compliance and auditing within ESG, there is a heightened risk of greenwashing, which can create significant reputational and financial risks. The lack of third-party auditors has caused many consumers, investors, and other stakeholders to be cynical concerning the reliability and validity of ESG reports, especially those completed internally.

The Importance of ESG Reporting by the Numbers

According to Natixis, almost three-quarters of investors and two-thirds of fund selectors say it is unclear which ESG-relevant data is material to investment analysis. In that same study, 71% of investors agreed that they want to make a positive social impact with their investments, and 81% said they want their investments to match their values. On top of that, 77% of fund selectors say ESG factor analysis is integral to sound investing.

Working with an Accounting Firm

Sustainability accounting improves transparency and validity, which is why using an accounting firm for ESG reporting is highly valuable. Accountants have a wealth of experience producing high-quality, audit-worthy deliverables, and these skills are transferrable to the nonfinancial aspects of a company. In the ESG field, there is a growing desire for ESG reports that mirror the compliance and regulation in financial reporting.

As regulation and auditing become more standard in reporting, having poor internal controls and inaccurate published reports can put a firm at risk. By using an accounting firm with regulatory and auditing experience in the financial aspects of business, a company can safeguard the risk of greenwashing by having audit-ready deliverables that accurately capture the environmental and social impacts and risks.

Similarities and Differences Between ESG and Financial Reporting

Presently, sustainability is seen as a buzzword rather than a well-established and defined approach. This starkly differs from financial reporting, which is held to much higher standards and regular auditing and compliance. The goal of financial reporting is to produce an accurate and detailed overview of the financial status of a company.

The same goals are present in sustainability; however, there is a notable lack of regulation. Both financial and sustainability reporting seeks to increase transparency and accountability, gain consumer and investor confidence, and improve a company’s overall reputation.

There is also a well-established link between a company’s financial performance and having stronger corporate social responsibility. Despite these similar goals, financial reporting continues to be much more standardized and regulated. The increase in third-party auditing and regulations will bring credibility to ESG reporting and increase opportunities and value creation.

How We Can Help You

Currently, private companies are not required to disclose. There is also an increasing number of retailers, investors, and consumers who want to know a company’s ESG commitments and stewardship before engaging in business to ensure this information is accurate and reliable.

It is then crucial to proactively compile thorough, accurate, and audit-worthy ESG reports sooner rather than later as market pressures continue to grow in this area. Due to the complicated nature of ESG reporting, working with an accounting firm can accelerate your business past competitors. Contact our team for more information about ESG reporting.