When most people think of fraud, schemes like email viruses, phone scams, and stolen credit card information come to mind. While most businesses have safeguards to prevent and detect these external threats, many business owners overlook the potential for occupational fraud—that is, fraud committed internally.

According to a 2024 study by the Association of Certified Fraud Examiners (ACFE), the construction industry is the seventh most affected industry for occupational fraud by the number of cases. Construction’s median losses of $250,000 ranked fifth among industries, slightly lower than the $267,000 in median losses reported by manufacturers.

Among all industries, companies lose the equivalent of about 5% of revenue to occupational fraud. The most common form of fraud is asset misappropriation such as billing schemes or theft of non-cash assets. The least common, but most costly, was financial statement fraud.

What Is Occupational Fraud?

Occupational fraud involves the deliberate misuse of an organization’s resources or assets by employees, management, and even owners with the goal of personal gain. Regardless of the perpetrator, the activity is almost always secretive, policies are usually violated, and the activity is committed for financial gain.

According to the ACFE, employees are more likely to commit fraud than executives. However, the dollar value associated with fraud significantly increases with the perpetrator’s seniority. Criminal motives are typically the result of stressors, including illness, excessive debt, or a spouse losing their job.

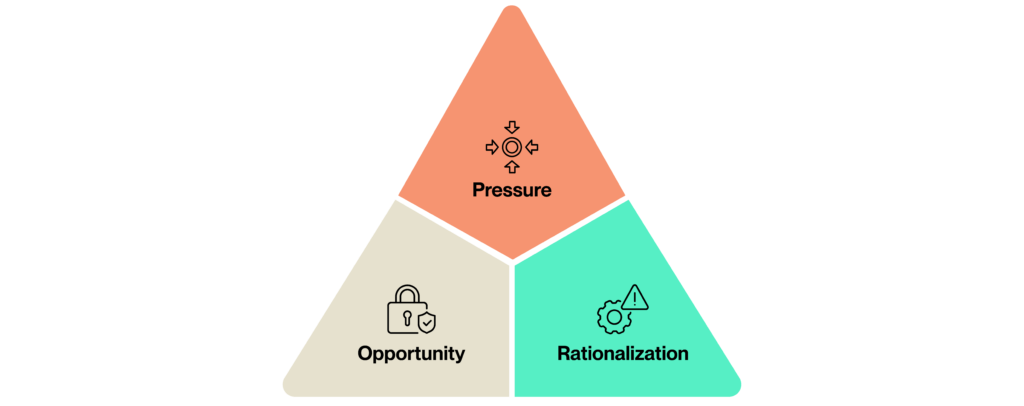

This financial or emotional pressure, mixed with the opportunity to commit the crime, often leads to the rationalization that the company can “afford” the loss. This “fraud triangle” model illustrates the possible factors that drive someone to justify and commit a crime.

Common Fraud Schemes

According to the ACFE, the most common fraud schemes within construction include corruption (52%), followed by billing (38%), expense reimbursement (25%), payroll and skimming (tied at 23%), and check and payment tampering (19%).

Corruption is a general term covering kickbacks, straw vendors, fictitious suppliers, bribery, bid-rigging, and conflicts of interest. Billing schemes include inflated costs on invoices, invoices for non-existent projects, or invoices for labor performed on personal projects. Accounts payable manipulation, check and payment tampering, fake or manipulated PDF documents, and cybersecurity are also frequent contenders.

Expense reimbursement fraud occurs when employees manipulate the expense reporting process to receive payments they’re not entitled to. Common schemes may include submitting fictitious expenses with fabricated receipts, mischaracterizing personal expenses as business-related, inflating legitimate business expenses (such as adding extra miles to travel), or submitting the same expense multiple times.

Payroll skimming fraud occurs when someone uses a company’s payroll system to divert company funds. Examples include creating “ghost employees” who don’t exist, inflating hours worked or commission amounts, failing to remove terminated employees from payroll, and similar schemes.

Identifying Fraud

Certain behavioral trends typically accompany occupational fraud. Unexplained purchases of luxury items such as cars and extravagant vacations could indicate someone living beyond their means. Employees who foster unusually close relationships with vendors or customers can also be cause for concern, especially if the employee safeguards information or becomes secretive about the account.

Employees exhibiting a “wheeler-dealer” attitude that allows them to work outside of routine procedures can often abuse power and trust. Employees who do not take a vacation or relinquish duties can also indicate suspicious activity. Being aware of these red flags and behavior changes can help identify potential misconduct and stop perpetrators early on.

Preventing Fraud

Creating a robust code of conduct and proactively enforcing internal controls can help strengthen security and mitigate major risks of loss. This doesn’t have to mean hiring more personnel, which can often be cost-prohibitive. There are plenty of effective checks and balances that contractors can implement to minimize the risk and impact of fraud:

- Creating a strong code of conduct and tone at the top

- Monitoring financials and bank statements for sudden changes or disparities

- Enforcing job rotation and mandatory vacation to ensure no single employee has consistent power over a particular function

- Reviewing expense reimbursement and budget-to-actual reports to discourage cost manipulation

- Conducting internal fraud training and creating a confidential hotline for employees to report suspicious behavior

- Conducting surprise audits to deter employees from manipulating systems or controls

- Scheduling audits of financial reporting and internal controls to monitor and ensure segregation of duties (especially for the purchasing and procurement process)

Even when fraud is caught, fear of bad publicity and costly legal fees often keep the crime out of court. Many business owners prefer private settlements and internal discipline to minimize costs and time away from the business. However, since many repeat offenders go unprosecuted, it’s critical to take legal action to create a strong deterrent and to alert future employers of an employee’s criminal record.

With these tips for understanding, identifying, and preventing occupational fraud, owners and stakeholders can be confident they are proactively mitigating the risk for their business.

To learn more about deterring and uncovering occupational fraud, contact us.