On November 4, 2025, the IRS released draft instructions for the 2025 Form 6765, Credit for Increasing Research Activities. The form remains largely unchanged from the 2024 version, with the most important update reflecting the requirement to complete Section G (the detailed reporting) being pushed out to tax year 2026.

Other items of note:

The schedule for control groups, common in the tech and medical industries, is affirmed to require an attachment with listed information and details about the individual companies and the group.

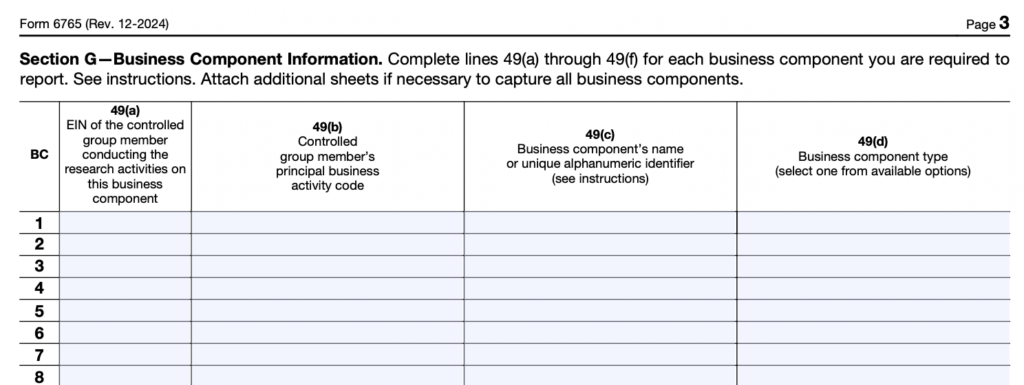

For control groups with entities completing Section G and filing separately, the information about the business components comprising 80% of the total Qualified Research Expenses (QREs) or the Top 50 projects (80%/Top 50) is for that entity, not the group.

The instructions also detail how to tabulate and detail expenditures included with the ASC 730 Directive. Companies with Certified Audited Financials can leverage the directive to provide Section G reporting as a single line item. These financial statements, often prepared for companies with high debt or bank obligations, external investors, or preparing for an IPO, can be leveraged to reduce the compliance burden for the R&D Credit.

These changes are intended to reduce the administrative overhead for small companies. Streamlining the reporting process should allow taxpayers to focus on innovation while making it more efficient for them to claim the Research and Development (R&D) tax credit.

Note that most companies are not currently taking the reduced credit due to Section 174 capitalization and amortization and $1.5 million in QREs is a credit of approximately $150,000.

Reduced Information Requests

The IRS also reduced the number of business components that must be reported on the revised Section G (formerly Section F in the draft released in late 2023). The June draft eliminates the questions about whether a business component is: new or improved; if it is for sale, license, or lease; and the narrative requirement outlining the information or discovery sought.

Taxpayers are no longer required to report 100% of total QREs: the revised draft is for 80% of QREs in descending order by amount, per business component, for up to 50 business components.

This revised Section G is also optional for all filers for the 2024 and 2025 tax years, giving taxpayers time to transition to the new requirements. Section G will be mandatory for the 2026 tax year for taxpayers unless they are otherwise eligible to skip.

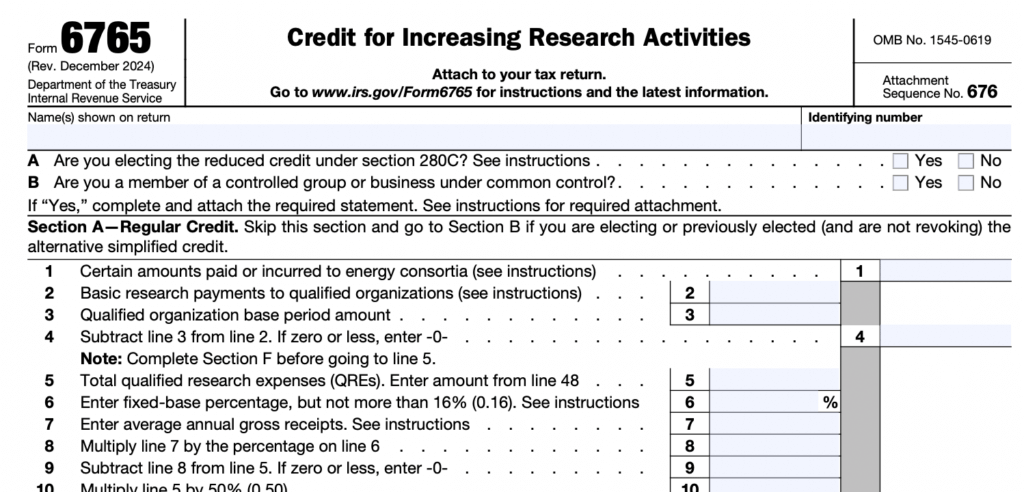

No Changes to Sections A and B with Slight Changes to C

There are no substantive changes to “Section A – Regular Credit” and “Section B – Alternative Simplified Credit.” While the purpose of “Section C – Current Year Credit” remains largely consistent, additional on-form instructions have been added to line 39.

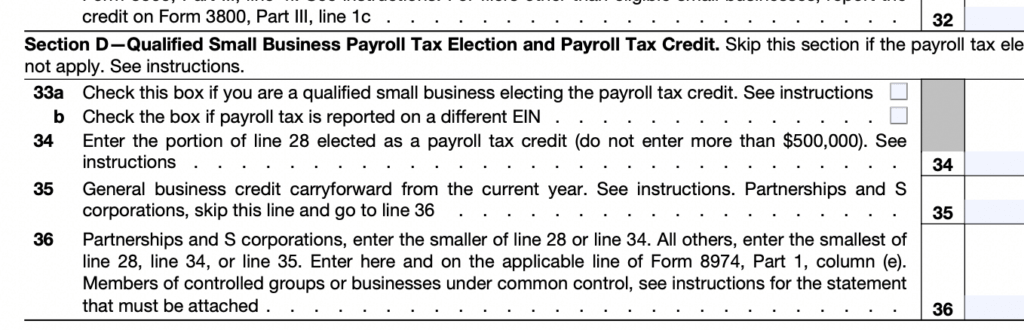

Added Checkboxes for Payroll Tax Credit Election Details

“Section D – Qualified Small Business Payroll Tax Election and Payroll Tax Credit” also adds additional checkboxes to clarify how the company is handling the credit, especially in cases of acquisition or entity change. Note that the form also includes the update to the payroll tax offset amount under Section 41(h), which increased to $500,000 for 2023.

Read our article “R&D Payroll Tax Credit Election for Small Businesses,” to learn more about applying the R&D tax credit against payroll taxes.

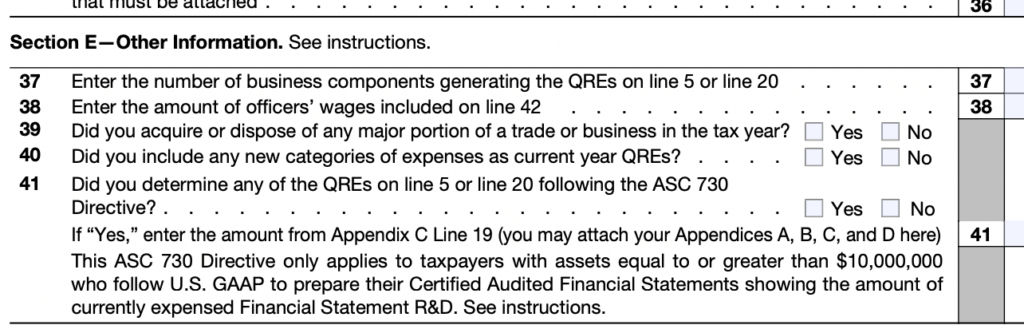

Significant Changes in New Section E

The biggest changes start in the new “Section E – Other Information.” The IRS is collecting data around the count of business components (an IRS term for “projects”) included, identifying officer wages being included as QREs, checking for transactions such as an acquisition or disposition, and flagging the consistency requirement as something to pay attention to.

While few of our clients are leveraging the ASC 730 directive for safe-harbor, other companies may be. The form requests disclosure of the ASC 730 amount.

What Should Taxpayers Do To Prepare?

While the required data points are not burdensome individually, the combination of details needed will add significant time and effort to data collection, analysis, and presentation to complete Form 6765 as proposed.

Companies with time-tracking and project-level accounting will generally be able to perform the arithmetic required to allocate expenses by business component and type of contributor. The key will be to make sure all non-wage expenses, like the supplies and outside contractors, are properly coded to the relevant business component. Also, a brief description should be kept available during the year to complete line 49 and substantially meet the requirements.

Companies with no time-tracking (or poor adherence) and accounting systems that do not allocate expenses to specific projects must track additional information to comply with the new requirements.

Four Additional Tips for Preparing

1. Include the project (business component) name in General Ledger entries, ideally as a separate field. Even listing it as a part of the additional information entered would be helpful.

2. If the company is considering time-tracking but hasn’t committed yet, implement it as soon as possible for all technical personnel. In addition to substantiating the R&D credit, this also provides visibility into the actual project development costs.

- Make sure personnel track all time worked, as we often see people track 40 hours whether they work 15 or 50.

- As much as possible, have first-line supervisors track their time contributing to projects rather than a single G&A or Overhead code.

- Track time spent by project for production, manufacturing, and quality personnel supporting prototype building and testing.

3. If the company does not have time tracking, consider quarterly surveys that include a project list and time allocation. These contemporaneous surveys often provide better data than a single, end-of-year survey and reduce the risk of data loss with staff departures.

4. Maintain a list of business components that includes key information such as:

- Project goal, including brief summary of any key technical goals and metrics

- Start date

- Key milestones

- End date – whether the project was put on hold, placed in production, or canceled

Our team of research & development tax credit experts provide engineering-based tax credit studies customized to meet your needs. Contact us with any questions regarding the R&D Tax Credit.

Original Published Date Feb 18, 2025