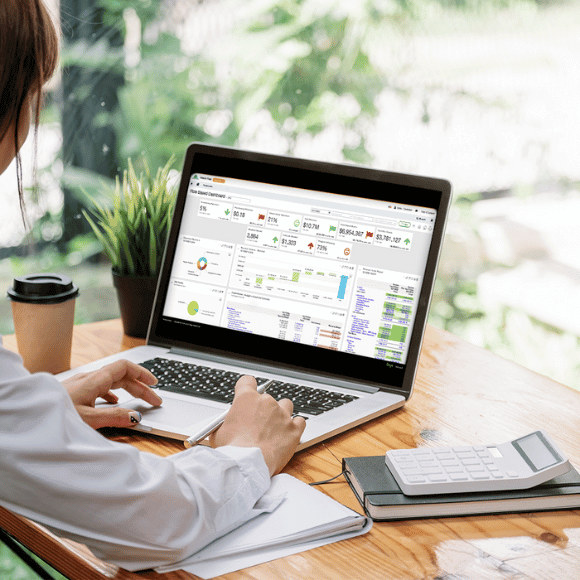

Sage Intacct Accounting Partner

Cloud-based accounting and financial management software that provides efficiency through automation, real-time insights, and robust financial reporting.

Let’s talk about your project.

Whether you need to unravel a complex challenge, launch a new initiative, or want to take your business to the next level, we’re here. Share your vision and we can help you achieve it.