BlackLine Software Partners and Implementation Consultants

Discover how we help organizations of all sizes leverage BlackLine to optimize their financial close, risk management and daily operations by replacing time-intensive, manual processes with an easy-to-use suite of powerful finance automation tools.

As a BlackLine Partner, Sensiba helps clients improve their finance function’s efficiency and controls by understanding your specific needs and collaborating to enhance overall effectiveness. Our team can help you through every step of the process from planning and implementation, system optimization, to training your staff.

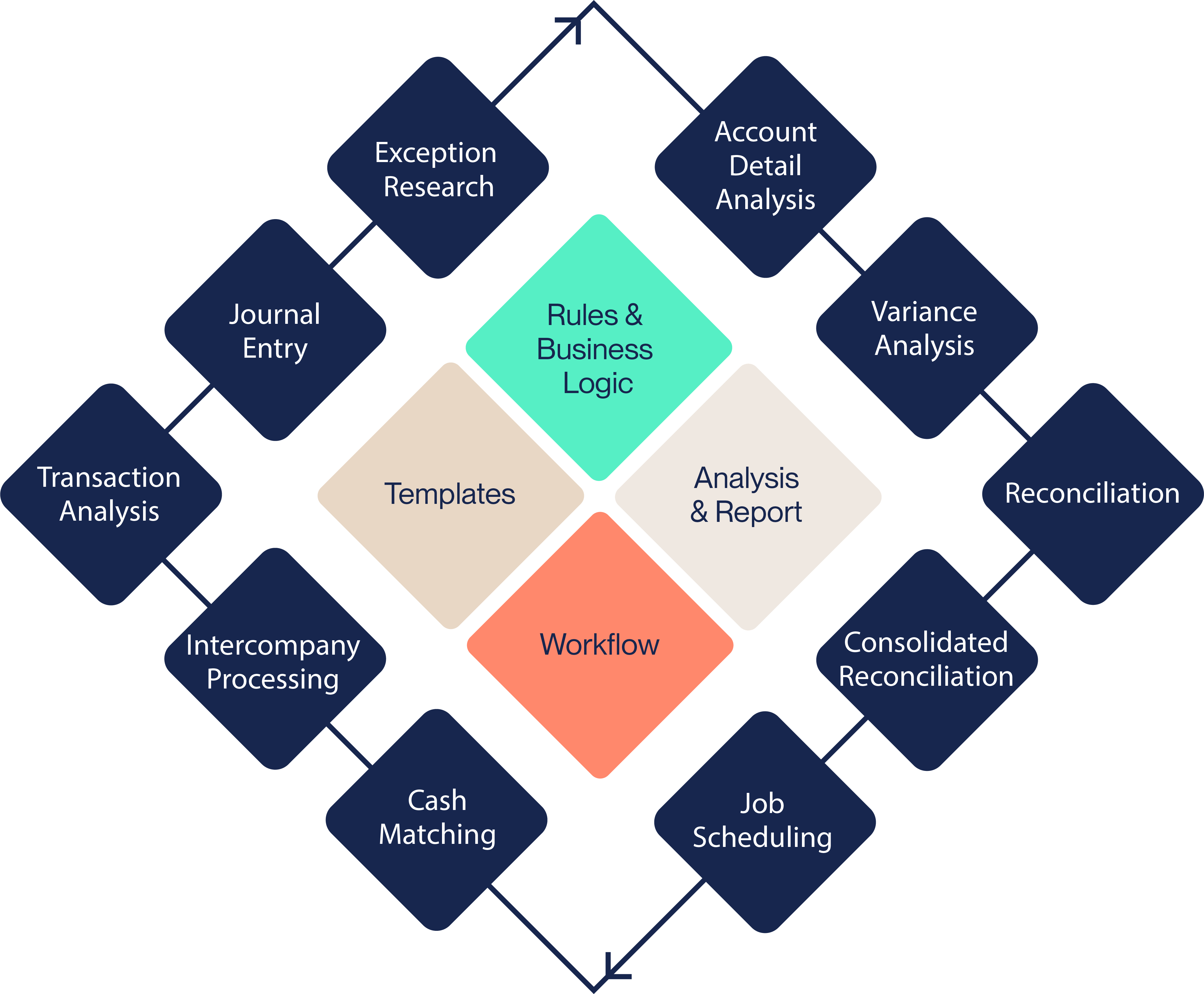

Harness the Power of BlackLine’s Modules

- Account Reconciliations

- Task Management

- Journal Entry

- Transaction Matching

- Variance Analysis

- Compliance

- Intercompany Hub

- Smart Close

- Cash Application

- AR Intelligence

Benefits Across Finance

Accounting Managers & Controllers

Gain transparency and visibility into financial operations to understand the organization’s potential and future outlook.

CFOs

Are better able to mitigate risk and manage business complexity while gaining efficiency and cost savings, and retaining top talent

Approvers

Can access leading close activities from a centralized system that locks down controls and ensures segregation of duties while providing a fully documented audit trail.

Preparers

Gain complete pre-close certification checklists and workflows that reduce manual inputs and leverage automation to enable timely financial results.

BLACKLINEBOOST

Optimize Your Existing BlackLine Implementation

In our free assessment, we’ll compare your implementation to leading industry practices to help you get the most from BlackLine’s powerful capabilities and automations. We’ll identify ways for you to utilize BlackLine more effectively and highlight the implications and potential risks of underutilized settings or tools within the platform. You can use the report’s guidance to implement these recommendations on your own, or, if you’d like to explore receiving assistance, we’ll schedule a discovery call and provide a quote for our services.

Begin your finance transformation.

Together, Sensiba and BlackLine offer informed expertise with a clear vision for any company to achieve its modern accounting goals. Contact our experienced team to begin harnessing the power and clarity of an optimized BlackLine implementation.