One of the defining characteristics of successful B Corporations is an affirmative commitment to continuous improvement. Obtaining B Corp certification, while impressive, is just the first step. B Corps continuously strive to improve their operations, reduce their impacts, and serve their stakeholders more effectively.

What is a Certified B Corp?

Certified B Corporations are companies that have been certified to have met rigorous standards of social and environmental performance, accountability, and transparency. The B Corp certification process assesses a company and its practices in categories including worker engagement, community involvement, environmental footprint, governance structure, and customer relationships.

Under B Lab’s Theory of Change, B Corps work “toward a world where business is a force for good, and plays a leading role in positively impacting and transforming the global economy into a more inclusive, equitable, and regenerative system.”

The B Corp movement began in 2006 with the idea that businesses could lead the way toward a stakeholder-driven economic model. In the following 18 years, more than 8,000 businesses in 96 countries have become B Corp Certified.

Digging Deeper: The Top Criteria for Certification

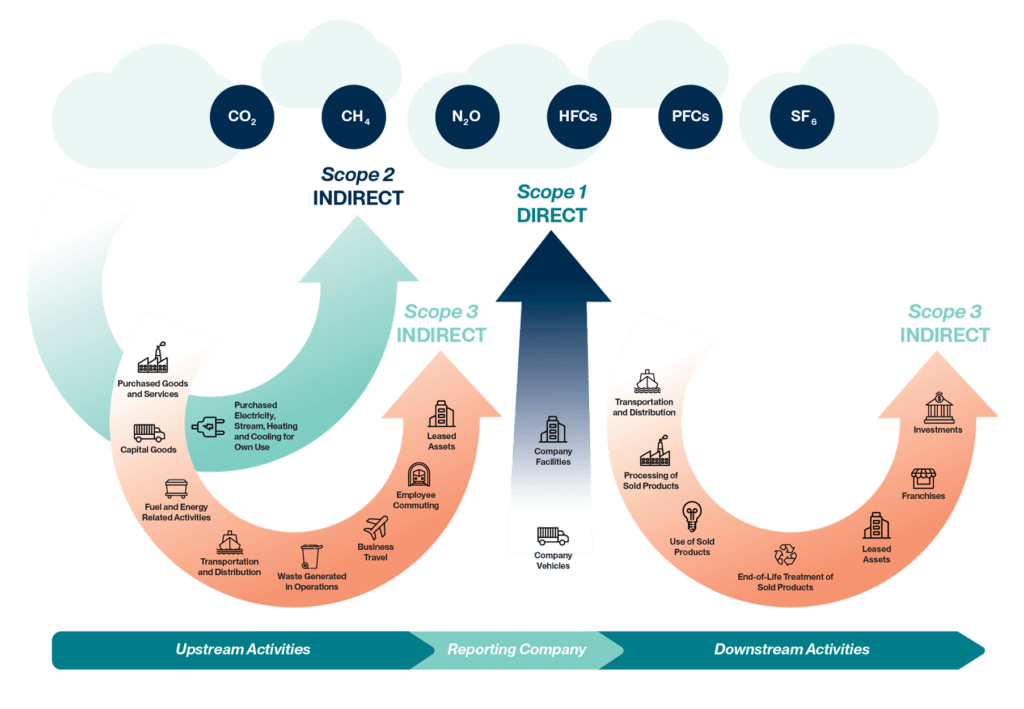

The primary criteria for certification are verified social and environmental performance, legal accountability, and public transparency. As part of the assessment process, companies must undergo an assessment of risk factors based on their industry and other practices. The risk factors are designed to smooth out variations in industries with inherently different environmental impacts and practices.

For instance, large multinational companies are asked to:

- Have a roadmap to trace the origin, and potential environmental and human rights impacts, of high-risk raw materials.

- Publicly disclose their gender wage gap.

- Have a public policy on responsible lobbying.

Similarly, bottled water companies must meet requirements around sustainable water usage, fair water access, and waste management.

Ongoing Improvement

For companies embracing the B Corp concept, completing the assessment and certification process involves a detailed review of the company’s existing processes and practices. The assessment includes answering more than 250-300 questions and providing verification documentation.

This detailed review identifies opportunities for improvement for the company and its operations, and often results in benefits beyond the certification process.

For instance, enhancing employee benefit programs can increase a company’s workforce engagement score but can also improve employee recruiting and retention. Values-driven consumers also appreciate doing business with companies that are focused on doing good. Becoming a B Corp allows companies to join a growing community of purpose-driven business leaders that, in turn, helps to unlock market and collaboration opportunities.

Once companies create a cadence for their internal reviews, the resulting improvement effort becomes self-reinforcing and often continues long after the initial certification.

According to B Lab, nearly two-third of organizations produce higher scores as they undergo the mandatory three-year recertification. For us at Sensiba, the 99.4 score we obtained during our 2022 recertification marked a 23% improvement from our 80.9 score during our initial certification in 2018.

B Corp Standards Evolving

Just as B Corps embrace continual change and improvement, B Labs applies a similar lens to its certification standards. In December 2020, B Labs announced it was reviewing the standards to reflect changing community and stakeholder expectations about companies making positive impacts on society and the environment. They also wanted to consider the evolving global regulatory landscape and have the changing B Corp standards better harmonize with the international regulations.

The new standards will examine applicants’ performance in fair wages, human rights, climate action, environmental stewardship and circularity, and a variety of other topics. Recertifying B Corps must also demonstrate continual improvement over the last three years since their last certification. This marks a change from the current “previous year” standards.

B Labs says the new standards will help clarify and promote effective and meaningful business practices while showcasing the B Corp movement’s role in driving positive change across the globe. The finalized version of the new standards is expected to be released in Q4 2024, with implementation phasing in during 2025.

For more information on what it takes to become B Corp certified and the benefits for your business, reach out to our sustainability and ESG team for an introduction.