The Intergovernmental Panel on Climate Change (IPCC) has released its Synthesis Report, which provides information on the physical science, impacts, and mitigation tactics addressing the climate crisis. The report confirms we have a brief window to avoid the most disastrous effects of climate change.

Acknowledging the contributions made by industry, the private sector has been mobilizing around corporate climate action, setting net-zero targets in accordance with the Paris Agreement goals adopted at the UN Climate Change Conference in 2015. The goal of net-zero emissions aligns with the scientific consensus that we must limit global warming to 1.5 degrees Celsius above pre-industrial levels.

What is Climate Neutrality?

Climate neutrality refers to mitigating greenhouse gas (GHG) emissions to achieve a net-zero carbon footprint. Becoming climate neutral involves reducing GHG emissions from your company’s operations to the extent possible and compensating for emissions that can’t be reduced. This compensation can take the form of carbon credits that help fund mitigation tactics to remove, offset, or avoid emissions.

Scope of Climate Neutrality

Although carbon dioxide is the largest overall contributor to climate change, climate neutrality covers all GHGs including methane, nitrous oxide, and hydrofluorocarbons, which have much higher global warming potential. This means smaller amounts of emissions lead to more accelerated warming. Some companies are going beyond commitments to climate neutrality. They are aiming to become climate positive by removing additional emissions beyond the scope of their own carbon footprint.

Why Should My Company Become Climate Neutral?

Pursuing climate neutrality goals can provide environmental, economic, and social benefits. Mitigating emissions can help reduce negative impacts on both people and the planet in the face of the climate crisis. This includes reduced biodiversity and worsening climate events such as drought, fire, heatwaves, and hurricanes.

Additionally, the impacts of climate change are not distributed equitably. Marginalized communities bear the brunt of environmental injustice by industrial polluters as well as extreme weather events. The U.S. has been the largest contributor to date of carbon emissions. This is why it’s worthwhile to reflect on our role in the global community.

Economic benefits come into play when a company considers differentiation within their market. Today, customers are looking to align their purchases with their values. According to the Yale Program on Climate Change Communication, 53% of Americans are alarmed or concerned about global warming.

Results from IBM sustainability research indicate almost half of consumers say they’ve paid a premium for products branded as sustainable or socially responsible. Companies actively engaged in creative emission reductions can gain a competitive advantage through innovation as well as benefits in attracting and retaining talent.

How To Achieve Climate Neutrality

The nonprofit leads a global movement of individuals and companies to eliminate carbon emissions. Their label, Climate Neutral Certified, is a trusted, independent standard that helps consumers identify brands that are leading on immediate climate action. Companies that get certified must reduce and compensate for all of their emissions resulting from the production and delivery of their products and services.

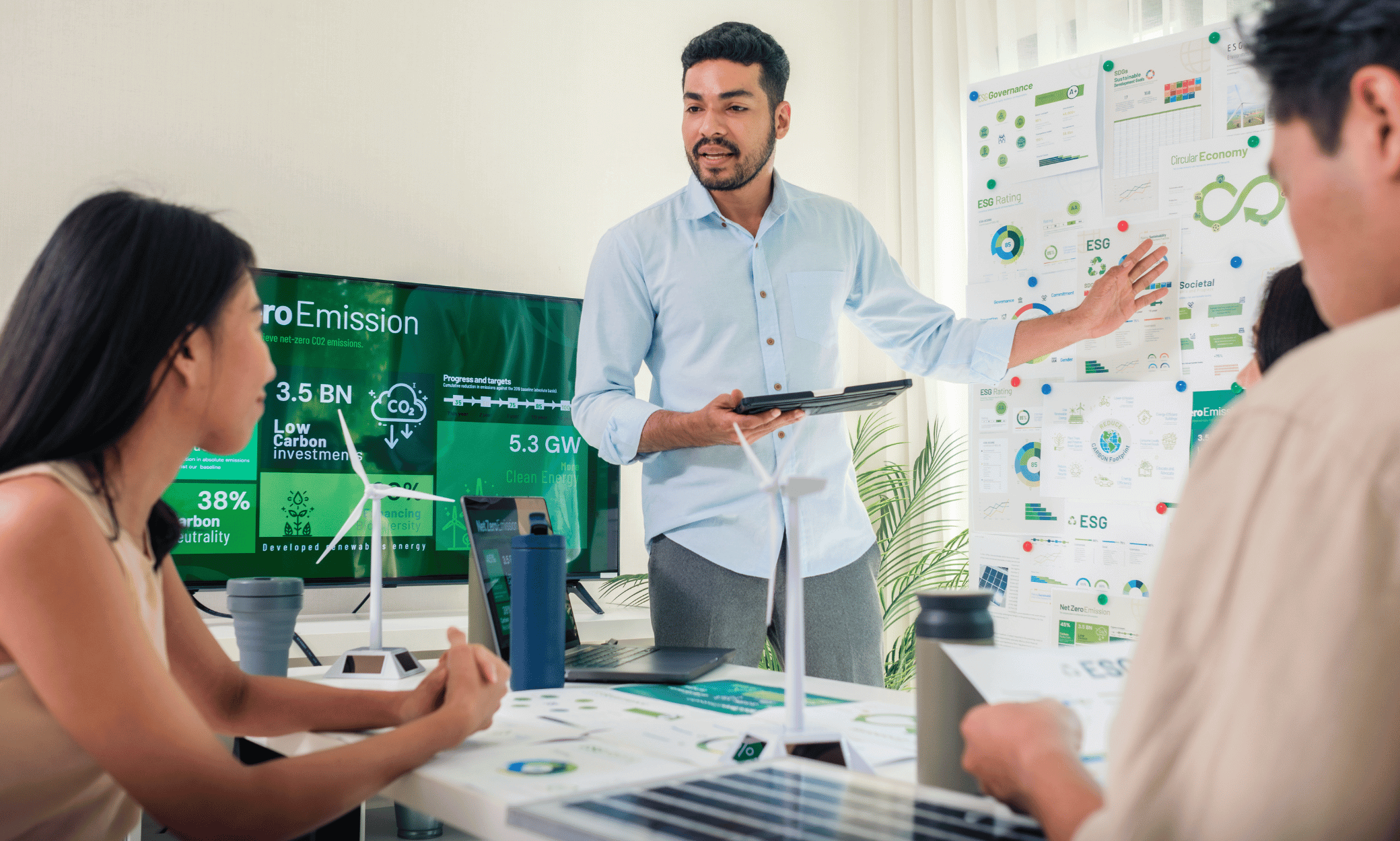

The first step begins with measuring your organization’s Scope 1, 2, and 3 GHG emissions to calculate your carbon footprint. Once you’ve accounted for your company’s emissions sources, you can examine that data to identify hotspots within your value chain. Then, you can target the largest contributors to your footprint.

Meaningful reduction action plans ensure employees across various departments become engaged with decarbonization efforts. This increases the organization’s likelihood of achieving success. By setting incremental goals and attaching metrics and KPIs on the way to climate neutrality, your company can start to track what’s working and what isn’t.

Reducing emissions takes time. Developing an offset strategy is the final part of mitigating the emissions your company has already created.

Cross-Sectoral Solutions

For many organizations, reducing emissions 50% by 2030 and achieving net zero by 2050 is the minimum target. Some companies are setting accelerated goals under The Climate Pledge, which is the goal of reaching net zero by 2040.

The U.S. public sector has also started to join the private sector in climate action. For example, the Inflation Reduction Act provides incentives to make adopting renewable energy easier and more cost-effective.

Recognizing that climate and social justice must be centered in all action taken, the Justice 40 initiative is promoting a transition away from a fossil-fuel dependent infrastructure in the U.S. by setting a goal that 40% of the benefits reach underserved communities.

With the looming SEC proposal requiring large public companies to disclose their emissions and the Corporate Sustainability Reporting Directive in Europe, the global regulatory environment continues to evolve.

The Key to Achieving Climate Neutrality Is to Start Now

Climate neutrality is achieved by measuring your company’s carbon footprint, understanding significant sources of emissions, and creating strategies to mitigate those emissions. Many corporate climate claims and sustainability initiatives lack immediacy and often omit Scope 3 value chain emissions. Becoming Climate Neutral Certified is an important step toward increased transparency, consumer trust, and accountability.

As a Climate Neutral Open Certification consulting partner, the Sensiba Center for Sustainability has expertise in GHG accounting, developing reduction strategies, setting science-aligned targets, and advising on verifiable carbon credits. Reach out to learn more about how you can take immediate action toward your emissions reduction goals.