Are you looking to have a business valuation or learn more about what they entail? We’ve got you covered. Below is our guide to business valuations: why you need them, what the process is like, what the benefits are, and how to get started.

What is Business Valuation?

A business valuation is a process used to determine the worth or value, in whole or in part, of a company. Your business might need a valuation for a variety of reasons. The purpose of your valuation is an important part of the valuation process; it guides the information collection and evaluation process.

Here’s a list of situations in which you might need a business valuation:

- Estate and Gift Planning

- Estate Filing

- Merger and Acquisition Transaction (M&A)

- Buy Sell Agreements

- Employee Stock Ownership Plan (ESOP)

- Subchapter S Election

- Litigation Support

What Does the Valuation Process Look Like?

If you decide to undergo a valuation, you’ll need to plan on having at least 3-5 years of financial statements (and/or federal income tax returns) available. If you anticipate major changes in the next few years (i.e., relocation, addental line of service/product), a forecast of income and expenses is essential.

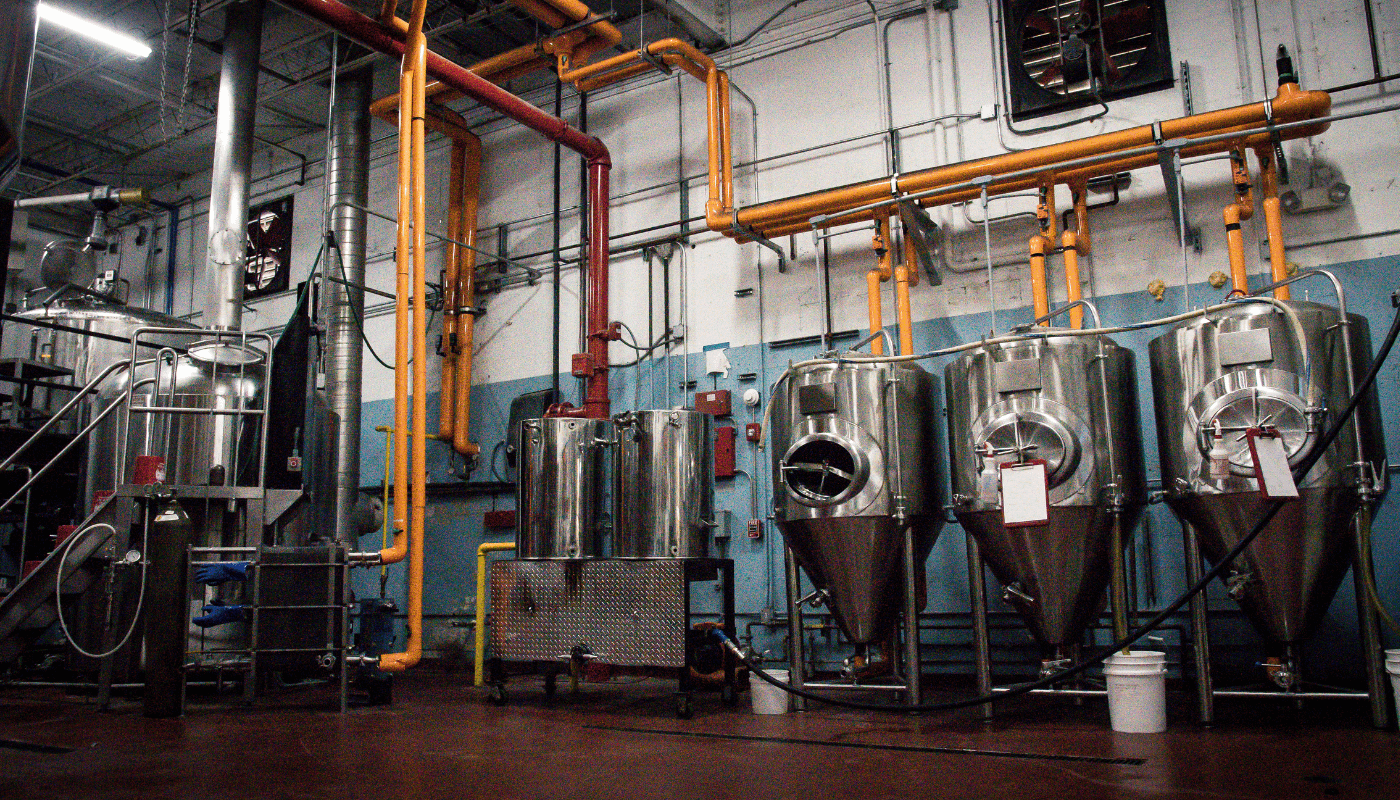

In addition to financial statements and returns, you must complete a questionnaire and provide company background/history and management information. The analyst evaluating your business will also meet with management and conduct a site visit.

Benefit of a Business Valuation

While a business valuation can be used to determine values for the above-mentioned purposes, it is also a tool to gain a better understanding of your operation compared to the industry. Business owners review the valuation exercise and identify issues that could materially affect the company’s value. Proper planning, including allowing adequate time, will help increase the company value and maximize your profit when you are ready to exit the business or admit new business partners.

Get Started with a Business Valuation

Our talented team of experts is ready to support your business through a valuation. We offer various levels of valuation support, ranging from valuations for internal use to a full valuation service culminating in a conclusion of value. Contact us to get started.